Why Wall Street Slumps as Trump Tariffs and Weak Jobs Data Shake Markets?

- Juan Allan

- Aug 5, 2025

- 3 min read

The dual impact sent stocks tumbling and raised the stakes for the Federal Reserve’s next policy move

Key Takeaways

Dow Jones drops 600 points as tariff fallout and poor labor data unsettle markets

Trump’s new tariffs target 70 nations, raising trade tensions worldwide

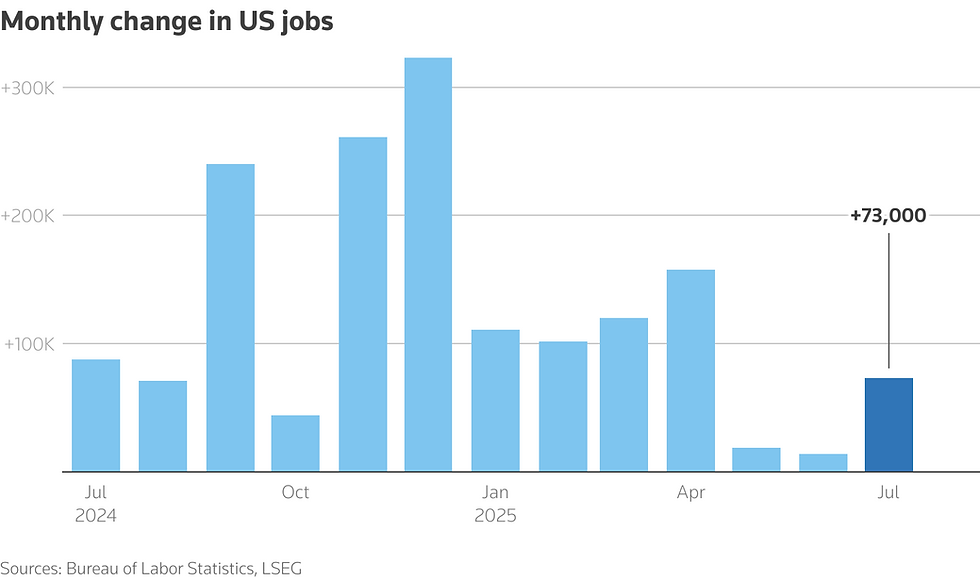

July jobs report misses forecast with only 73,000 new jobs added

Wall Street suffered a sharp downturn on Friday, July 26, 2025, as President Donald Trump signed an executive order imposing aggressive new tariffs on 70 countries, marking one of the largest trade offensives of his administration.

The sweeping measures, ranging from 10% to as high as 41%, coincided with a dismal U.S. jobs report that revealed major labor market weaknesses, intensifying fears of a broader economic slowdown.

Trump’s Global Tariff Blitz Rattles Markets; Dow Sinks 600 Points as U.S. Job Growth Stalls at 73,000

The Dow Jones Industrial Average slid nearly 600 points, while the S&P 500 and Nasdaq dropped 1.6% and 2%, respectively. Global markets followed suit, with the UK’s FTSE 100 and Germany’s DAX each declining more than 1%.The tariff shock came on two fronts.

First, Trump’s executive order imposed tariffs ranging from 10% to 41% on imports from 70 countries, escalating tensions with traditional allies and trade partners. Canada faced the steepest duty at 35%, with Switzerland, South Africa, India, and Taiwan also heavily affected. Most of these measures are set to take effect between August 1 and August 7.

Canada's Prime Minister, Mark Carney, expressed his disappointment at Trump's tariff hike. Carney stated in a statement via his X account on Friday morning that he was “disappointed” with Trump’s tariff hike, adding that “Canadians will be our own best customer.”

Brazil was initially hit with a 10% “reciprocal” tariff, but a new executive order issued on Wednesday adds a further 40% levy starting August 1, citing the ongoing prosecution of former President Jair Bolsonaro. This brings the total tariff on Brazilian goods to 50%.

Second, the U.S. economy added just 73,000 jobs in July, far below analysts’ consensus estimates of 110,000. Previous months’ job gains were also revised downward, wiping out an additional 258,000 jobs. The unemployment rate increased to 4.2%, highlighting weakening labor market momentum.

Employment gains averaged 35,000 jobs per month over the last three months compared to 123,000 a year ago. Uncertainty over where tariff levels will eventually settle has made it harder for businesses to plan long-term, economists said.

“There was little to celebrate in the July Employment Report,” Thomas Ryan, North America economist for Capital Economics wrote. He stated that the three-month average employment gain had now fallen to “a troublingly low 35,000 – a figure that is difficult to interpret as anything other than a sign of hiring stalling, even as population growth slows.”

Policy Uncertainty Deepens Investor Anxiety

The dual blow from trade tensions and labor market softness has heightened speculation that the Federal Reserve may cut interest rates in September.

"The president's unorthodox economic agenda and policies may be starting to make a dent in the labor market," stated Christopher Rupkey, chief economist at FWDBONDS. "The door to a Fed rate cut in September just got opened a crack wider. The labor market is not rolling over, but it is badly wounded and may yet bring about a reversal in the U.S. economy's fortunes.”

Treasury yields dipped across the curve, with the 10-year yield falling to 3.71% as investors moved into safe-haven assets. Gold prices surged past $2,090 per ounce and the dollar weakened against major currencies. Market sentiment remains fragile, with traders anticipating further volatility in the weeks ahead.

Analysts expect these pressures to weigh on corporate earnings and consumer confidence, especially if the tariffs begin to affect prices and supply chains. With global economic activity already subdued, further tightening in trade flows could amplify downside risks heading into Q4 2025.

Comments